Understanding the Foundation of Good Credit

In the world of personal finance, few things are as important as building good credit. A solid credit history opens doors to financial opportunities, from securing low-interest loans to qualifying for attractive mortgage rates. However, for many, the process of building good credit can feel overwhelming. How do you start? What mistakes should you avoid? And how long does it take to see results? This guide will walk you through the basics of building good credit, providing actionable steps to set you on the path to financial freedom.

What Is Good Credit, and Why Does It Matter?

Before diving into strategies, it’s essential to understand what good credit actually means. In simple terms, good credit refers to a history of responsible borrowing and repayment. Lenders use your credit score—a numerical representation of your creditworthiness—to assess how likely you are to repay loans or credit card balances on time.

A high credit score, typically in the range of 700 to 850 or higher, indicates good credit. The higher your score, the more favorable loan terms you’ll qualify for, including lower interest rates and higher credit limits. On the other hand, a low credit score can make it difficult to secure loans or result in higher interest rates, increasing the cost of borrowing.

Good credit matters because it’s a key factor in achieving long-term financial goals. Whether you’re planning to buy a home, finance a car, or even start a business, your credit score will play a pivotal role in your success. A strong credit profile also demonstrates financial responsibility, which can benefit you in unexpected ways, such as securing better insurance rates or even landing a job.

Understanding Credit Scores

To build good credit, you need to understand how credit scores are calculated. The most commonly used credit scoring model is FICO, which evaluates five main factors:

Payment History (35%): Your track record of paying bills on time is the most significant factor in your credit score. Late payments can have a severe negative impact.

Credit Utilization (30%): This refers to how much of your available credit you’re using. Keeping your credit utilization below 30% is generally recommended.

Length of Credit History (15%): A longer credit history provides more data for lenders to assess your borrowing behavior.

Credit Mix (10%): A diverse mix of credit types (e.g., credit cards, loans) can positively influence your score.

New Credit (10%): Applying for multiple new lines of credit in a short period can signal financial distress and lower your score.

By understanding these factors, you can take targeted actions to improve your credit score and build a strong financial foundation.

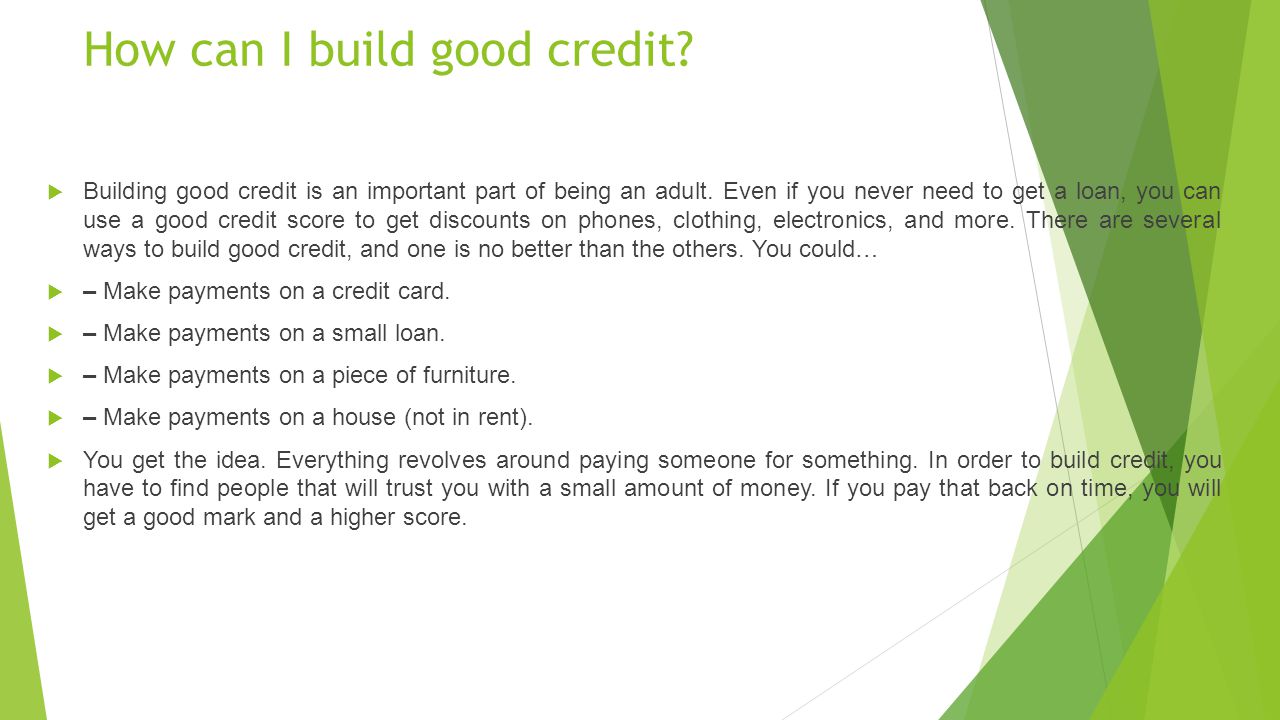

Building Credit from Scratch

If you’re starting with no credit history, the process of building good credit can seem daunting. However, with patience and discipline, it’s achievable. Here are some strategies to help you get started:

Apply for a Secured Credit Card

A secured credit card is an excellent tool for building credit. Unlike unsecured cards, these require a security deposit, which is usually equal to your credit limit. As you use the card responsibly and make timely payments, the issuer reports your activity to credit bureaus, helping you establish a positive credit history.

Become an Authorized User

If you’re younger or lack a credit history, consider becoming an authorized user on a family member’s credit card. As long as the primary account holder has good credit, your responsible use of the card will be reflected in your credit profile.

Start Small with Loans

Another option is to apply for a small personal loan or a credit-builder loan. These loans allow you to demonstrate your ability to repay debt on time, which is a crucial factor in building credit.

The Power of Consistency

One of the most crucial elements of building good credit is consistency. Lenders want to see a history of reliable repayment behavior. This means making payments on time, every time. Even minor late payments can have a lasting impact on your credit score.

To stay consistent, consider setting up automatic payments for credit cards, loans, and utilities. This ensures that bills are paid on time, even if you’re short on cash or forget deadlines. Additionally, tracking your payment due dates in a calendar or financial app can help you stay organized.

Avoiding Common Credit Mistakes

As you work to build good credit, it’s equally important to avoid mistakes that could sabotage your efforts. Some common pitfalls include:

Maxing Out Credit Cards: High credit utilization signals to lenders that you’re overextended financially.

Missing Payments: A single missed payment can linger on your credit report for up to seven years.

Closing Old Accounts: Closing old credit card accounts can negatively impact your credit history and utilization ratio.

By being proactive and avoiding these mistakes, you can protect your credit score and build a strong financial foundation.

Patience and Persistence

Building good credit isn’t a quick process. It requires time, effort, and consistent positive behavior. While you can see improvements in your credit score within a few months, building excellent credit takes years. The key is to stay patient and persistent, focusing on small, incremental steps that add up over time.

For example, if you currently have a limited credit history, start by opening a single credit account and using it responsibly. Over time, you can add more accounts or loans to diversify your credit mix. Each positive action you take will contribute to a stronger credit profile.

Final Thoughts on Part 1

Building good credit is a journey, not a destination. It requires understanding the components of a credit score, avoiding common pitfalls, and maintaining consistent, responsible behavior. By starting with small steps, such as opening a secured credit card or becoming an authorized user, you can begin building a positive credit history that will serve you well in the future.

In the next part of this guide, we’ll explore advanced strategies for maintaining and improving your credit score, including monitoring your credit report, avoiding debt, and the importance of financial education. Stay tuned as we continue to unlock the secrets to achieving financial freedom through good credit.