In the world of finance, there are numerous investment strategies that cater to different investor preferences and goals. Among the most popular are Value Investing and Growth Investing. While both strategies aim to generate returns, they differ significantly in their approach, criteria, and risk profiles. This article delves into the core differences between Value Investing and Growth Investing, helping you understand which strategy might align better with your investment objectives.

Value Investing, Growth Investing, Investment Strategies, Warren Buffett, Benjamin Graham, Peter Lynch, Financial Metrics, Risk vs. Reward, Market Valuation, Traditional vs. Innovative Companies

Understanding Value Investing

Value Investing is a strategy that focuses on identifying undervalued assets or companies with the potential to outperform the market. This approach is rooted in the belief that the market often mispractices the true worth of certain companies, creating opportunities for investors to profit.

The concept of Value Investing dates back to the early 20th century, when Benjamin Graham and David Dodd, often referred to as the fathers of Value Investing, introduced the idea in their seminal work Security Analysis. Graham later popularized the strategy in his book The Intelligent Investor, where he emphasized the importance of intrinsic value—the underlying worth of a company separate from its market price.

At its core, Value Investing relies on three key principles:

Intrinsic Value: This is the true value of a company, calculated based on its financial performance, assets, and other fundamental factors. Value investors believe that the market price of a stock may deviate from its intrinsic value, offering an opportunity to buy low and sell high.

Margin of Safety: Graham introduced the concept of a margin of safety, which suggests that investors should only buy a stock when its market price is significantly below its intrinsic value. This provides a buffer against potential errors in valuation and market volatility.

Long-Term Perspective: Value Investing is a long-term strategy. Investors are encouraged to hold onto their undervalued stocks until the market recognizes their true worth, which can take several years.

Characteristics of Value Investing

Value Investors typically look for companies that exhibit the following characteristics:

Low Price-to-Earnings (P/E) Ratio: A low P/E ratio indicates that the stock is trading at a lower price relative to its earnings. Value Investors interpret this as a sign that the stock is undervalued.

Low Price-to-Book (P/B) Ratio: A low P/B ratio suggests that the stock is trading below its book value, which is the value of the company's assets minus its liabilities.

High Dividend Yield: Value Investors often prefer companies that pay high dividends, as this provides a steady income stream while they wait for the stock price to appreciate.

Strong Financial Health: Value Investors favor companies with strong balance sheets, low debt, and consistent cash flow.

Famous Value Investors

The strategy of Value Investing has been employed by some of the most successful investors in history, including:

Warren Buffett: The renowned investor and CEO of Berkshire Hathaway is often cited as a quintessential Value Investor. Buffett focuses on companies with strong fundamentals, a competitive advantage, and a reasonable valuation.

John Templeton: Known for his global investment approach, Templeton searched for undervalued companies worldwide, often investing in emerging markets and turnaround situations.

Mohnish Pabrai: A disciple of Warren Buffett, Pabrai has built a successful career by applying Value Investing principles, focusing on companies with a clear competitive edge and a sustainable business model.

Advantages of Value Investing

Potential for High Returns: By purchasing undervalued stocks, Value Investors aim to capitalize on the eventual revaluation of these assets, leading to substantial gains.

Risk Management: The emphasis on a margin of safety reduces the risk of significant losses, as Value Investors avoid overpaying for stocks.

Long-Term Focus: Value Investing encourages a patient, long-term approach, which can lead to more stable and predictable returns compared to short-term trading strategies.

Challenges of Value Investing

Patience and Discipline: Value Investing requires a long-term perspective and the ability to withstand short-term market fluctuations.

Identifying True Value: Determining the intrinsic value of a company can be subjective and challenging, especially in volatile markets.

Market Mispricing: While the market may misprice stocks, it can sometimes remain mispriced for longer than anticipated, leading to extended holding periods.

Understanding Growth Investing

Growth Investing is a strategy that focuses on companies with high revenue growth potential, regardless of their current valuations. Unlike Value Investing, which emphasizes undervalued assets, Growth Investing prioritizes companies that are expected to grow significantly in the future.

The concept of Growth Investing gained popularity during the 1960s and 1970s, particularly among investors who sought to capitalize on the rapid expansion of technology and innovation-driven companies. Growth Investors believe that companies with strong earnings growth, market leadership, and competitive advantages will outperform the market over time.

Characteristics of Growth Investing

Growth Investors typically look for companies that exhibit the following characteristics:

High Revenue Growth: Growth Investors are drawn to companies with a history of consistent revenue growth and the potential for continued expansion.

Strong Earnings Growth: Companies with rapidly increasing earnings per share (EPS) are attractive to Growth Investors, as this indicates a strong profit-generating capability.

Market Leadership: Growth Investors often target companies that are leaders in their respective industries, as these firms are more likely to dominate the market and realize their growth potential.

Innovative Products or Services: Growth Investors favor companies that are at the forefront of technological advancements or offer unique products that can capture significant market share.

High P/E and P/B Ratios: Unlike Value Investors, Growth Investors are willing to pay a premium for high-growth companies, reflected in higher P/E and P/B ratios.

Famous Growth Investors

Some of the most successful Growth Investors include:

Peter Lynch: The former manager of Fidelity Magellan Fund is known for his Growth Investing approach, focusing on companies with strong fundamentals and growth potential.

Jim Cramer: The well-known financial pundit and host of Mad Money often advocates for Growth Investing, emphasizing companies with high revenue growth and strong management teams.

Bill Gates: While not traditionally classified as an investor, Bill Gates' investments in companies like Microsoft and other technology firms reflect a Growth Investing mindset, focusing on the potential for exponential growth.

Advantages of Growth Investing

High-Potential Returns: Growth Investors aim to capture significant gains by investing in companies that are poised for rapid expansion and innovation.

Focus on Innovation: Growth Investing aligns with the growth of emerging industries and technologies, providing exposure to cutting-edge companies.

Market Leadership: By targeting market leaders, Growth Investors aim to benefit from the competitive advantages and economies of scale that these companies possess.

Challenges of Growth Investing

High Valuations: Growth Investors often pay a premium for high-growth companies, which can lead to significant losses if the growth expectations are not met.

Volatility: Growth stocks are often more volatile than Value stocks, as they are sensitive to changes in market conditions and investor sentiment.

Short-Term Focus: Growth Investing can sometimes lead to a short-term focus, as investors may prioritize growth at the expense of long-term sustainability.

Comparing Value Investing and Growth Investing

While Value Investing and Growth Investing are distinct strategies, they share a common goal: generating superior returns in the stock market. However, their approaches, risk profiles, and suitable market conditions differ significantly.

1. Approach to Valuation

Value Investors focus on identifying undervalued companies, applying rigorous financial analysis to determine their intrinsic value. They seek to exploit market inefficiencies and capitalize on mispricings, often targeting companies with strong fundamentals but lower valuations.

Growth Investors, on the other hand, are less concerned with current valuations and more focused on the potential for future growth. They are willing to pay a premium for companies with high earnings growth, innovative products, or market leadership, believing that these companies will deliver significant returns over time.

2. Investment Horizon

Value Investing is a long-term strategy, as it often takes time for the market to recognize the true value of undervalued companies. Investors must be patient and willing to hold their positions through market cycles.

Growth Investing can be more short-term in nature, as investors may exit positions once their growth expectations are realized or the stock reaches a certain price target. However, successful Growth Investors often adopt a medium to long-term perspective to fully capitalize on the growth potential of their investments.

3. Risk Profile

Value Investing is generally considered less risky than Growth Investing due to its focus on undervalued, financially stable companies. The margin of safety provides a buffer against potential losses, making it a more conservative approach.

Growth Investing carries a higher risk due to the premium paid for growth potential and the volatility of growth stocks. The failure of growth projections or market headwinds can lead to significant losses.

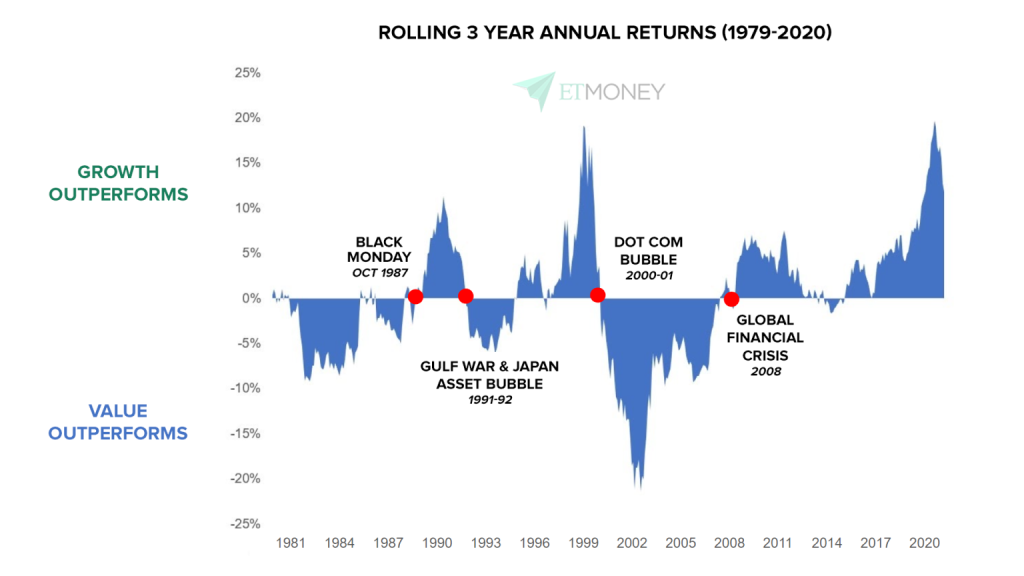

4. Suitable Market Conditions

Value Investing tends to perform well in mature markets or during market downturns when many companies are undervalued. Investors can capitalize on the inefficiencies created by panic selling or overreactions to negative news.

Growth Investing is most effective in bull markets or during periods of economic expansion, when investor sentiment is favorable, and growth stocks can thrive.

5. Example Companies

Value Investing: Companies like Procter