Understanding Economic Cycles and Their Influence on Investments

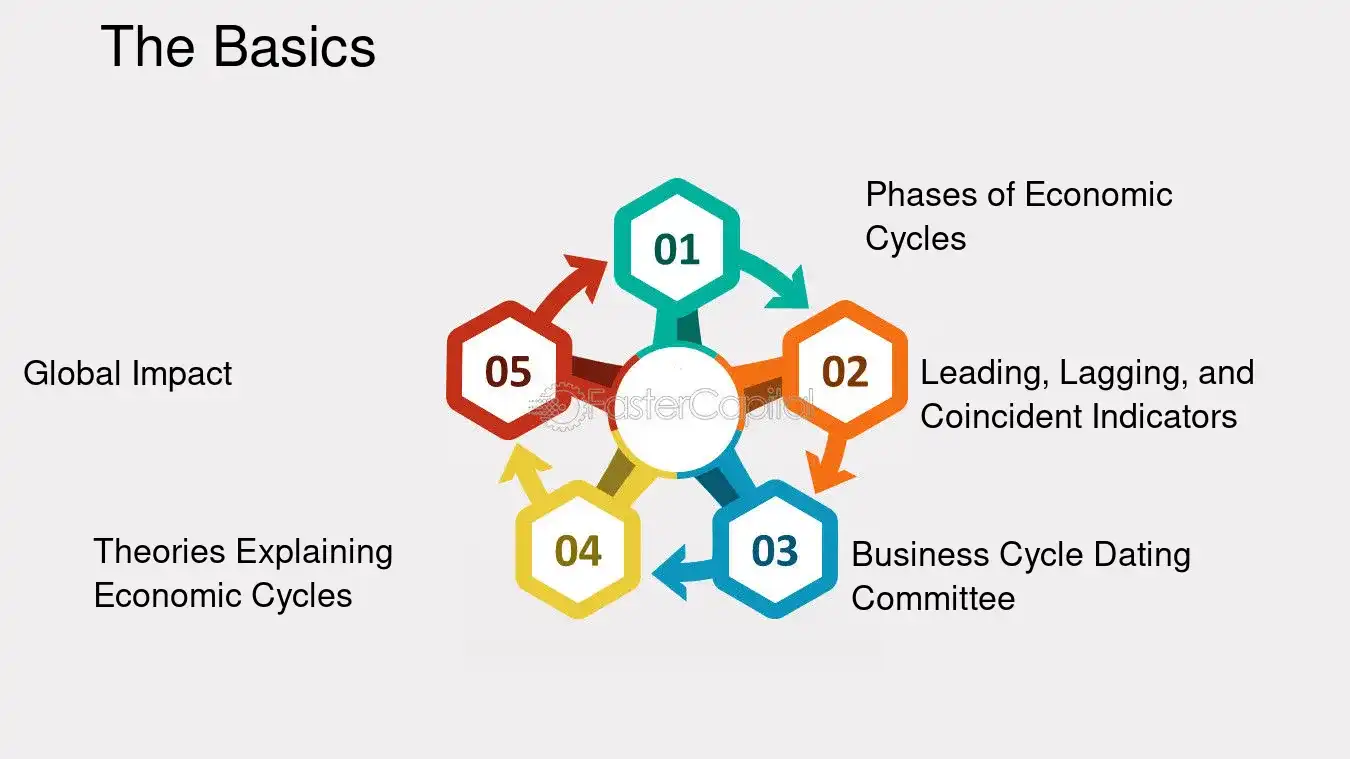

Economic cycles are the natural fluctuations in economic activity, consisting of periods of growth and decline. These cycles, often categorized into four phases—recession, recovery, expansion, and peak—have a profound impact on investment strategies. Whether you're a seasoned investor or just starting out, adapting your approach to the current economic phase can make the difference between success and failure.

1. The Recession Phase: Navigating Uncertainty

Recessions are marked by decreased economic output, rising unemployment, and falling prices. During this phase, investors face heightened uncertainty, and traditional safe-haven assets like bonds and gold often gain favor. However, not all sectors suffer during a recession. For instance, utilities and consumer staples tend to perform relatively well due to their stable demand.

Investors should consider diversifying their portfolios to include defensive assets while keeping a portion of their capital in cash for opportunities that arise during market dips. Additionally, it's crucial to avoid panic selling, as holding onto quality assets during downturns can lead to long-term gains when the economy rebounds.

2. The Recovery Phase: Identifying Growth Opportunities

As the economy begins to recover, investor sentiment tends to improve, and riskier assets like equities start to gain traction. This phase is often characterized by rising corporate earnings, increased consumer spending, and a general sense of optimism.

Investors should look for sectors poised to benefit from economic recovery, such as industrials, materials, and technology. Emerging markets and small-cap stocks may also outperform during this phase, as they are more sensitive to improving economic conditions. However, it's essential to avoid overextending your portfolio into high-risk assets too early, as volatility can still occur.

3. The Expansion Phase: Maximizing Returns

During the expansion phase, the economy is growing steadily, and corporate profits are robust. This is typically the best time to invest in equities, as growth stocks often outperform during this period. Additionally, real estate and commodities like oil and metals may see strong returns as demand increases.

However, this phase can also be deceptive. As the economy continues to expand, interest rates may rise, which can impact bond prices and limit the performance of fixed-income assets. To mitigate this risk, investors should consider a mix of growth and income-generating investments, maintaining a diversified portfolio to balance risk and return.

4. The Peak Phase: Preparing for the Downturn

The peak phase marks the end of an expansion, where economic growth begins to slow, and inflation may rise. At this stage, investors should start preparing for the eventual downturn by reducing exposure to high-risk assets and increasing their holding of safer investments.

Defensive sectors like healthcare and consumer goods may continue to perform well, while cyclical sectors like energy and materials may begin to underperform as economic growth slows. Diversification and maintaining a long-term perspective remain key during this phase, as market conditions can change rapidly.

In conclusion, understanding the impact of economic cycles is essential for crafting effective investment strategies. By aligning your investments with the current economic phase and staying flexible, you can navigate market fluctuations and maximize your returns over the long term.

Adapting Investment Strategies to Economic Fluctuations

As the economy moves through its cycles, successful investors are those who can adapt their strategies to changing conditions. This requires not only a deep understanding of economic indicators but also a willingness to reassess and adjust your portfolio regularly.

1. Dynamic Portfolio Management

Dynamic portfolio management involves continuously monitoring market conditions and rebalancing your investments to align with the current economic phase. For example, during a recession, you might increase your allocation to bonds and defensive stocks, while in an expansion, you could shift more money into equities and growth-oriented assets.

Rebalancing ensures that your portfolio doesn't become overly exposed to any one asset class, reducing risk and enhancing returns. It also forces you to take a disciplined approach to investing, avoiding emotional decisions driven by short-term market volatility.

2. Leveraging Market Trends

Economic cycles create opportunities for investors to profit from emerging trends. For instance, during an expansion, consumer discretionary sectors like retail and leisure tend to perform well as disposable incomes rise. Similarly, during a recession, technology and healthcare sectors often show resilience due to their essential nature and innovation-driven growth.

By identifying these trends early, investors can position their portfolios to capitalize on them. However, it's important to avoid chasing short-term trends that may not have long-term staying power. Instead, focus on sectors and companies with strong fundamentals that are likely to thrive over multiple economic cycles.

3. Avoiding Common Pitfalls

One of the biggest mistakes investors make is failing to adapt their strategies to the changing economic landscape. For example, sticking to a buy-and-hold strategy during a recession can lead to significant losses, while chasing high-risk assets during an economic peak can result in a nasty surprise when the market corrections.

Another common error is overreacting to short-term fluctuations. Market volatility is a natural part of economic cycles, and attempting to time the market perfectly is rarely successful. Instead, focus on maintaining a long-term perspective and making incremental adjustments to your portfolio as conditions change.

4. Future-Proofing Your Investment Strategy

As the global economy continues to evolve, new challenges and opportunities will emerge. Factors like technological innovation, demographic shifts, and geopolitical tensions will play an increasingly important role in shaping economic cycles.

To future-proof your investment strategy, consider incorporating exposure to emerging markets, renewable energy, and other sectors poised for long-term growth. Additionally, embracing a mix of passive and active investment strategies can help you navigate an uncertain economic landscape.

In conclusion, the impact of economic cycles on investment strategies cannot be overstated. By staying informed, maintaining flexibility, and adopting a disciplined approach, investors can not only survive but thrive in an ever-changing financial world.

This concludes the two-part soft article on "The Impact of Economic Cycles on Investment Strategies."